Want Access to Chinese Remittances? You Need to Crack Alipay

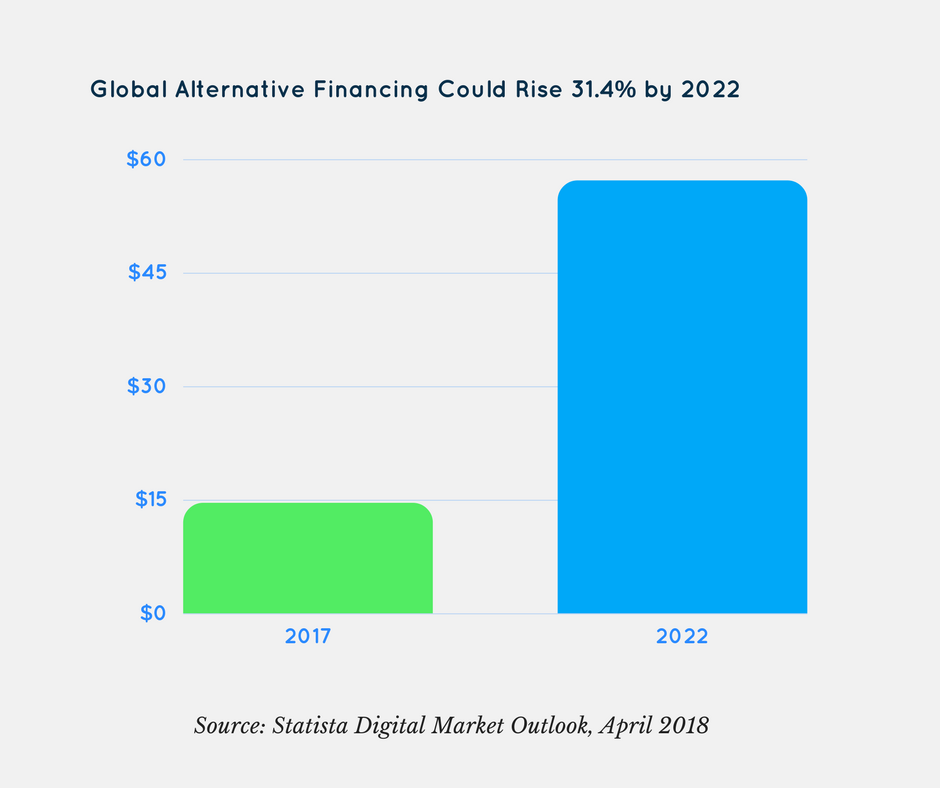

With global remittances expected to grow by more than 4% this year, providers are utilizing mobile and other digital technologies to ensure sending money between countries is easier than ever. China, the world’s most populous country, has citizens all over the world, and huge amounts of money are flowing back and forth, which should make […]